Questions about Funding Grandchildren Attending College?

Questions about Funding Grandchildren Attending College?

Since undergraduate degrees usually help adults earn more throughout their lives, most young people still hope to attend college. However, financing this type of education often proves too expensive for many teens and their parents. Fortunately, many grandparents have decided to step into this financial void and help out.

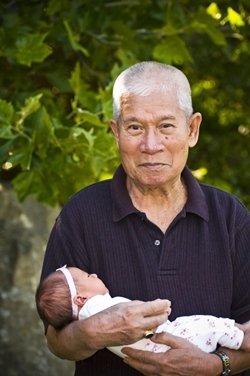

Since few things bring more joy to older Americans than giving meaningful gifts to their grandchildren, this approach to financing college often winds up pleasing several generations.

However, before you try to pay for any portion of a grandchilds college education, you need to obtain the help of an experienced Minnesota estate planning attorney. He can tell you how to disburse funds in a manner that will minimize problems for your estate while also helping your grandchilds efforts to keep qualifying for future financial aid.

How Many Grandparents Are Seeking This Type of Advice?

According to a survey referenced in a New York Times article published on May 27, 2016, about half of todays grandparents are helping their grandkids cover at least some of their college expenses. In fact, this type of help has become critical since many private colleges now charge over $40,000 per academic year and state universities charge in-state students average annual fees of about $17,000.

Heres some more useful information about how you might go about helping your grandchildren pay their college expenses.

Ways to Tailor an Estate Plan So Your Grandkids Can Graduate with Far Less Debt

- Consider giving the money for your grandchilds college expenses directly to his/her parents. This approach can result in the money being assessed at a lower rate as parental income — as opposed to the grandchilds income. Doing this can also avoid negatively affecting your grandchilds ability to qualify for future financial aid. Your Minnesota estate planning attorney can explain all of this to you in greater detail;

- Give serious thought to paying your grandchilds tuition (and perhaps other educational expenses) directly to the school. However, doing this is normally only recommended if your grandchild is unlikely to qualify for any need-based financial aid;

- Ask your estate planning attorney if giving your grandchild certain stocks or bonds can prove useful. However, keep in mind that this approach might create certain tax problems for one or more family members.

Other Useful Suggestions for Helping to Finance a Grandchilds College Education

- Start early. You need to begin putting money in accounts for your grandchildren when theyre still quite young so the funds will have plenty of time to grow over the years;

- Find out how 529 plans work. There are different options you can use when setting up a 529 plan in some states;

- Check on the security of your own financial future. Make sure youre properly funding your own 401(k), IRA, and any pension or retirement accounts before trying to help one or more grandchildren;

- Decide if you should maintain control of certain accounts set up to help your grandchild. Youll need to determine whether you should fully control all assets placed in any account designed to help your grandkids. This can prove critical should you and your spouse experience unexpected financial crises. If youve kept control of a 529 account, you can still withdraw funds from it for non-educational purposes. However, youll probably have to pay certain taxes and other penalties for such withdrawals.

Multigenerational college funding allows an entire family to share the joy of helping the youngest members pursue their academic dreams.

Free Initial Consultations

Contact the Flanders Law Firm today. The firm offers free consultationsto all potential clients. Call 612-424-0398.