Minnesota Table of Heirship

Minnesota Table of Heirship

In most cases, the heirs of an estate – when there is not will – are the living relatives of the deceased. Most non-lawyers understand this.

However, most non-lawyers do not understand exactly which relatives come first. Additionally, the surviving spouse has very significant rights under Minnesota law. We will discuss each in turn.

Who Are the Heirs?

First, if there is a surviving spouse but not children, the surviving spouse receives everything.

Second, if there are children and a surviving spouse – things get complicated.

Third, if there are children but no surviving spouse, the children get everything.

Simple enough right?

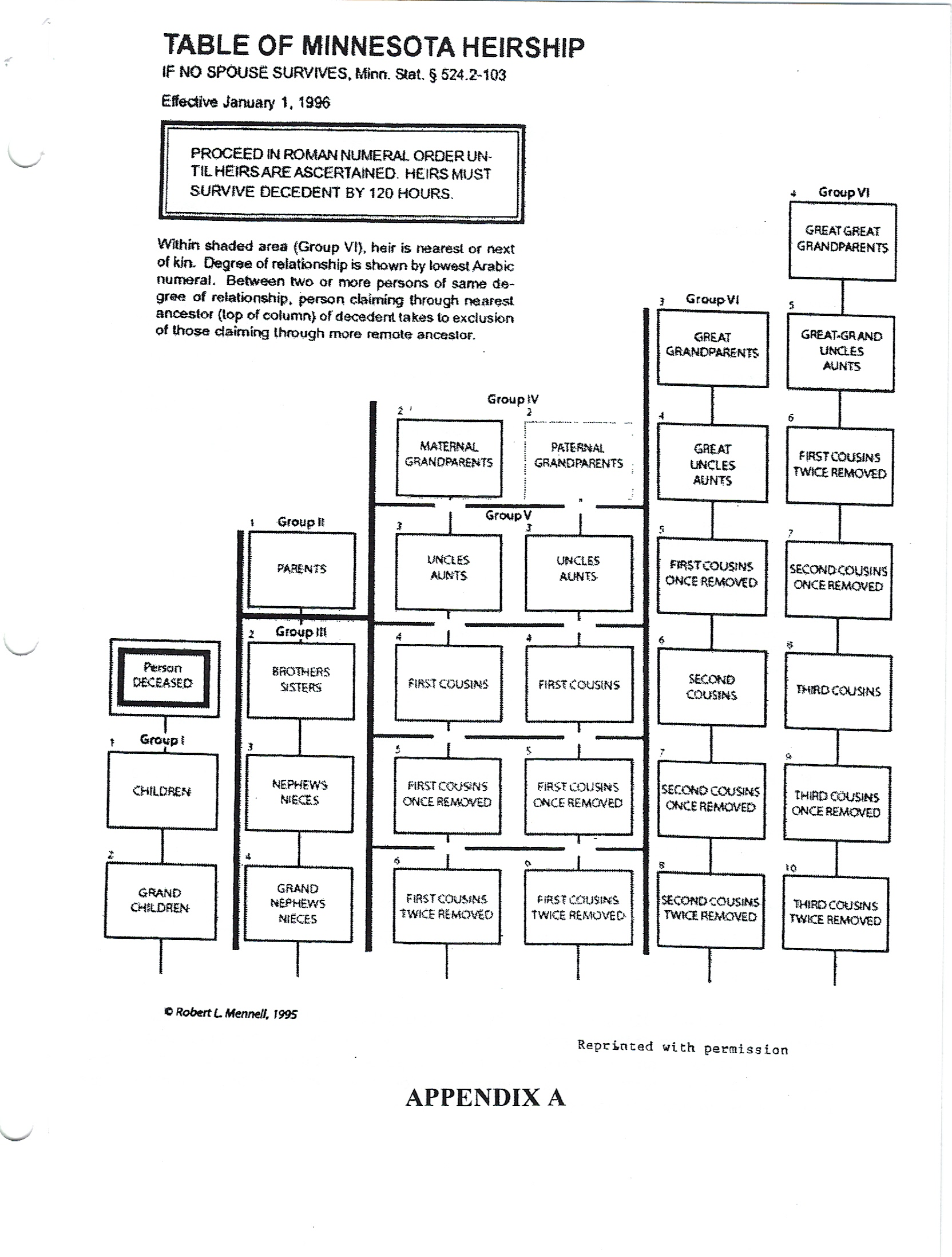

Table of Minnesota Heirship

Minnesota law also tells us that, under Minnesota Statute 524.2-103(1), that, if the deceased left no surviving spouse, all of the deceased’s relatives receive the estate by “right of representation.” Right of representation, under Minnesota, goes as follows:

- Children

- Grand-children

- Parents

- Brothers and sisters

- Nephews and nieces

- Grand nephews and nieces

- Maternal and Paternal Grandparents

- Aunts and Uncles

- First Cousins

- First Cousins Once removed.

Though this list is not totally complete under the Minnesota Table of Heirship, it does give a breakdown of how most estate devolve in Minnesota. Our office has dealt with an estate where the first cousins were the heirs a large estate. Although it is infrequent, it does happen.

Below is a chart showing the Minnesota Table of Heirship

Notice of the Estate Administration

It is important to note that many people may be entitled to “notice” of the estate. This means that “interested persons” must receive written notice of the beginning of the estate and any petition to appoint a personal representative over the estate. Most importantly, people who are not heirs, or who may be receiving nothing from the estate, may still be entitled to written notice. If you have questions about this, you should contact an experienced probate attorney. If you want to be appointed as the personal representative of the estate, you must give proper written notice. For more information on this topic, read this article on how to be appointed as a personal representative.

Minnesota Probate Lawyers

Contact Flanders Law Firm LLC to speak with an experienced probate attorney who has deal with many different estates of all different sizes. Contact the firm today for a free initial consultation at 612-424-0398.

For identified unclaimed property (money), if the deceased was divorced and has two surviving adult children. Do they have to divide the unclaimed property/money with their underage grandchildren, the deceased 2 siblings and their children (nieces & nephews of the deceased)?

The unclaimed property is only $110. We’re wondering if it’s worth submitting a claim for it.

In a situation with no Will, the surviving children of the deceased receive the entire estate.

Father passed, one of his children passed before him. Does the child of the passed child, granddaughter, receive his portion?

Were 4 children, now three, but we’re supposed to split everything by 4 still?

Hello. Please give me a call at 612-424-0398. I would be happy to discuss this with you.